Contents

I. Achievements in attracting foreign investment capital in 2023

According to information from the Foreign Investment Agency under the Ministry of Planning and Investment, the last months of the year have witnessed a strong recovery, bringing the total value of foreign investment capital in 2023 to a record level, a sharp increase compared to the year 2022.

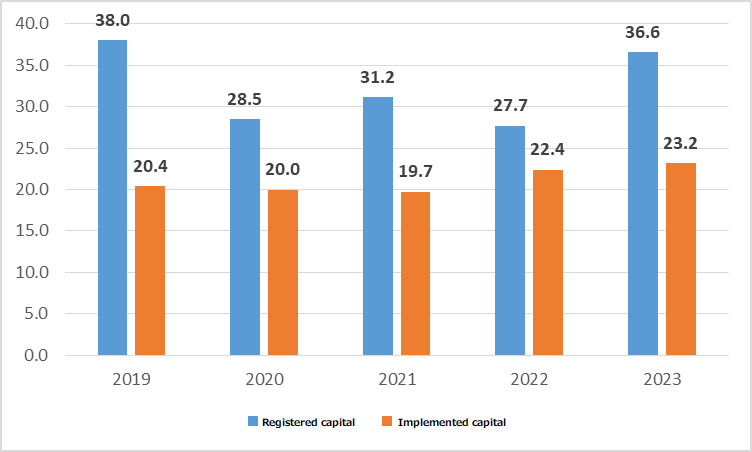

Detailed numbers show the stability and attractiveness of Vietnam. By December 20, 2023, registered foreign investment capital had reached 36.61 billion USD, an increase of 32.1% over the same period. In particular, capital for implementing projects also reached 23.18 billion USD, an impressive number with an increase of 3.5% compared to 2022.

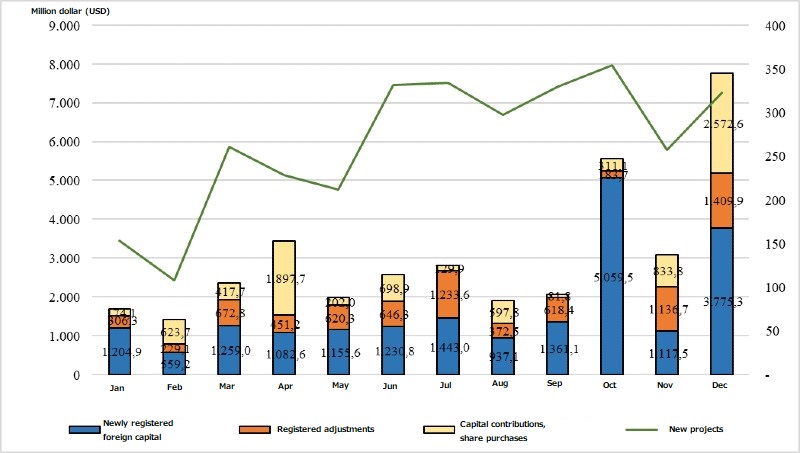

It is worth noting that statistics show that not only did newly registered capital increase sharply, but also the number of new projects also recorded significant growth. With nearly 20.19 billion USD in newly registered capital and 3,188 new projects, up 62.2% and 56.6% respectively, Vietnam is showing increasingly strong attraction.

In addition to new registered capital, 2023 will also witness investment capital adjustments in 1,409 projects, an increase of 14%. Although it decreased over the same period, the decrease has improved, a positive sign of investors’ confidence in long-term business prospects in Vietnam.

Another bright spot is that investment capital through capital contributions and share purchases has increased significantly to more than 8.5 billion USD, while reducing fluctuations in transactions.

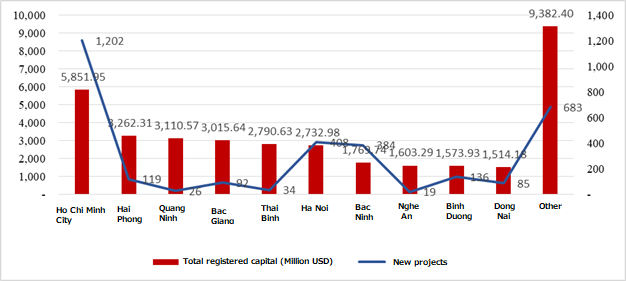

Areas that attract foreign investment continue to be provinces and cities with good infrastructure, stable human resources and favorable policies. In particular, Ho Chi Minh City, Hai Phong, Quang Ninh, Bac Giang, Thai Binh, Hanoi, Bac Ninh, Nghe An, Binh Duong and Dong Nai account for 78.6% of new projects and 74.4% of total foreign investment capital in 2023.

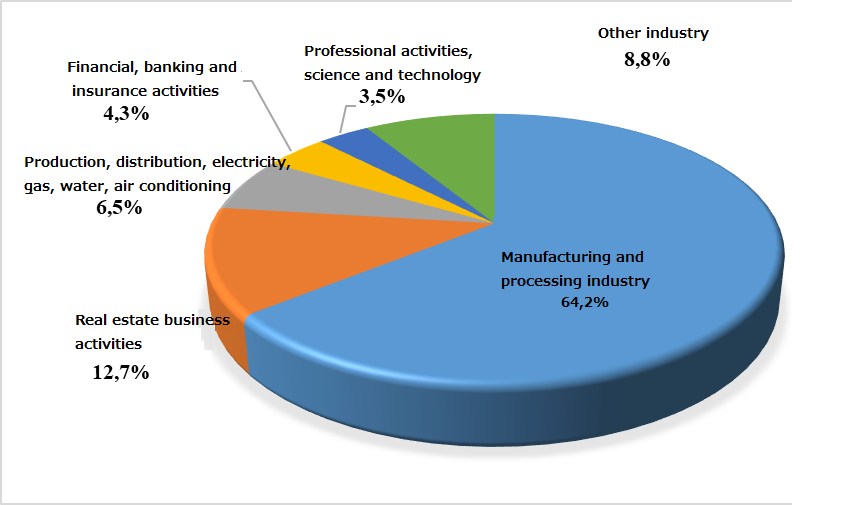

Regarding investment, the processing and manufacturing industry continues to be the main driving force with more than 23.5 billion USD, accounting for 64.2% of total registered investment capital. Real estate and other industries also recorded an increase, being an important resource brought into the economy.

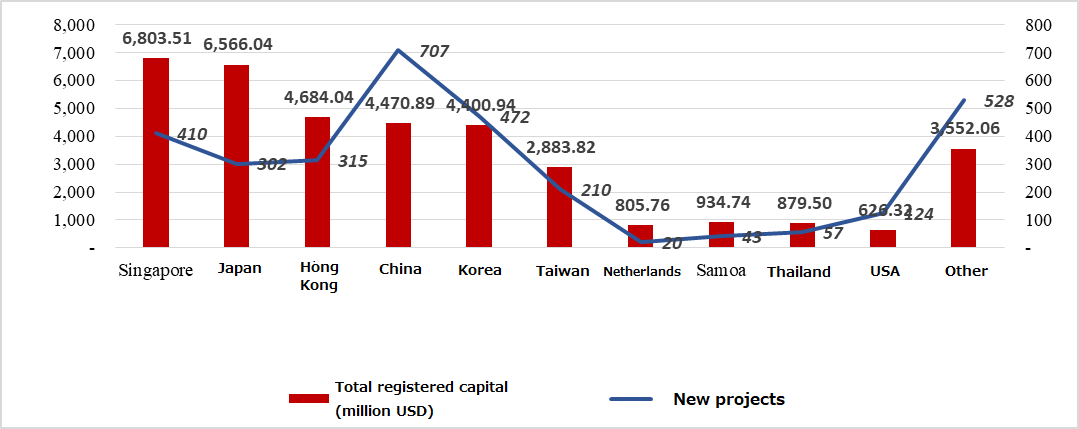

While many countries and territories participate in investment in Vietnam, Singapore, Japan and Hong Kong continue to be the most important partners. With diversity in capital sources and proactive investment promotion, Vietnam continues to affirm its position on the international investment map in 2023.

II. Some limitations and recommendations to improve the effectiveness of attracting FDI

Except for the successes that have been achieved, attracting FDI in Vietnam also faces many certain challenges and limitations, as follows:

1. Low Connectivity and Spread

- The connection and spread of FDI projects to the domestic investment sector is not high.

- Technology transfer from FDI to domestic enterprises has not reached expectations, mainly in the field of assembly and processing.

- The localization rate in some industries is still low, the added value has not reached a high level.

2. Technology and Machinery

- Machinery, equipment, and production lines used in FDI enterprises are not superior to domestic enterprises.

- The number of FDI enterprises with high technology capacity is still limited, only 5% have high technology, 80% have medium technology.

- Few FDI enterprises establish research and development (R&D) centers.

3. Uneven Distribution

- The proportion of FDI attraction in different sectors is not uniform, with a large focus on wholesale and retail, processing, manufacturing and real estate.

- FDI projects mainly focus on fields that are not environmentally friendly and have low added value.

4. Current Situation of Transfer Pricing and Tax Evasion

- FDI enterprises still tend to transfer pricing and avoid taxes in Vietnam.

- Transfer pricing tricks include raising the price of fixed assets when contributing investment capital and raising the price of imported raw materials.

III. Recommendations to improve efficiency in attracting FDI in the future

1. Improving Institutions and Laws

- Build institutions and policies to attract FDI with outstanding incentives to attract large and high-tech projects.

- Amend laws on technology transfer and machinery import to control and promote technology transfer.

2. Improving the Investment Environment

- Review and amend investment policies, support investors to reduce difficulties.

- Improve state management of FDI from promotion to supervision of project implementation.

3. Screening FDI Projects

- Prioritize projects which have advanced and efficient technology, and connection to the global value chain.

- Carefully consider proposals from foreign investors, especially in important fields that may affect national security.

4. Enhancing Monitoring and Transparency

- Build a synchronous information system on FDI enterprises for effective assessment and monitoring.

- Publicize information about the operations and finances of FDI enterprises to prevent socio-economic risks.

5. Improving the Capacity of Domestic Enterprises

- Domestic enterprises need to improve their technology, management and labor skills to attract investment from FDI enterprises.

IV. SUMMARY

In 2023, Vietnam attracts a record of more than 36.6 billion USD in FDI, an increase of 32.1% over the previous year. The data shows Vietnam’s stability and attractiveness in increasing the number of new investment projects. However, there still exist challenges in connectivity, technology, etc. To increasingly attract FDI capital in the future, it is necessary to improve institutions, investment environment, and strengthen supervision to improve efficiency. attracting FDI in the future, while strengthening the capacity of domestic enterprises.